Household Economic Strengthening (HES)

MF HES activities are targeted at improving the economic situation of families through increased savings, income generating activities, better resource utilization, improved business skills, and revolving loan schemes. Some of the services provided through these activities include:

- Value chain development and Market Analysis

- Microfinance support (Grants, Savings and Loan)

- Vocational/apprenticeship training

- Micro Enterprise Fundamentals Training

- Livelihood opportunity

- Financial Education

- Linkage to public sector scheme(s)

- Linkages to cash transfer scheme

- Private sector linkage(s)

- Income Generating Activity (IGA)

- Village Savings and Loan Association (VSLA)

- Referral

HES officers supervising VSLA groups in Project communities

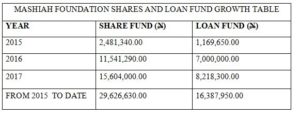

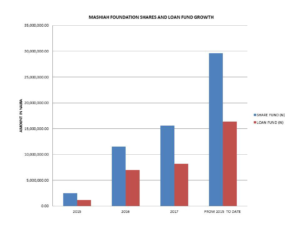

MF through this intervention, MF has trained over 3,000 Caregivers (CG) in various Income Generating Activities (IGA) and Vocational Skills. 88 functional VSLAs have been established with total savings of over ₦29,626,630 Twenty nine million, six hundred and twenty six thousand, six hundred and thirty naira) ($97,136.49) from 2014 to date. Over ₦16,387,950 (Sixteen million, three hundred and eighty seven thousand, nine hundred and fifty naira) $53,730.98 i.e. 55% of savings has been accessed by 921 Caregivers as credits facilities (Loan) from 2015 to date to start/support businesses and other household expenses. Furthermore, 250 caregivers were trained on Micro Enterprise Fundamentals and the use of seasonal calendar (i.e. household income and expenditure budget).

With reference to 2017 VSLA cycle, an average of 8% interest was paid on loans collected across various groups, 5% was paid as social fund to support members when need arises (i.e. emergencies and unforeseen circumstances) 56% of share fund was accessed as loan fund. At the end of each cycle various VSLA groups led by their management committees conduct an audit of shares purchased, loans given out, interest on loans collected, outstanding loans, calculate new share price, fix a date and notify members on the day for share out. For instance groups with initial share price of ₦100 (One hundred naira) arrive at a new share price of ₦115 (One hundred and fifteen naira), which means that for every share of ₦100 purchased by members, a profit of ₦15 was made from the interest given out as loan. The new share price is then multiplied by the number of shares bought by each member to arrive at what each member takes home. Apart from the profit made on each share, members have been able to strengthen their businesses and in turn cater for the needs of their households through the loans collected at different times of the year.

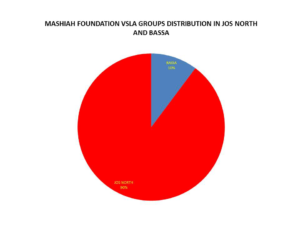

These VSLA groups are spread across 25 project communities in Jos North and 5 communities in Bassa LGAs of Plateau State (79 and 9 VSLA groups respectively).

Cross section of HES officers & caregivers during Market Simulation (part of MEF) training in project communities

As a way of improving business techniques and acumen, MF trained project beneficiaries on Micro Enterprise Fundamentals, Value Chain/Market analysis, and financial literacy. Beneficiaries have been linked to public and private schemes such as Bank of Agriculture, Micro Finance Banks, Plateau State Agricultural Development Program, Plateau State Ministry of Commerce and Industries, National Directorate of Employment etc.